(Apple Stock) Apple shares jumped in extended trading Thursday as the company announced revenue and earnings. The company’s fiscal second-quarter revenue fell 4% to $90.75 billion, while net income fell 2% to $23.64 billion. Apple reported record-high service revenue at $23.87 billion, a 14% year-over-year increase.

In addition, the Apple company increased its dividend from 4% to 25 cents per share and announced a $110 billion share buyback program.

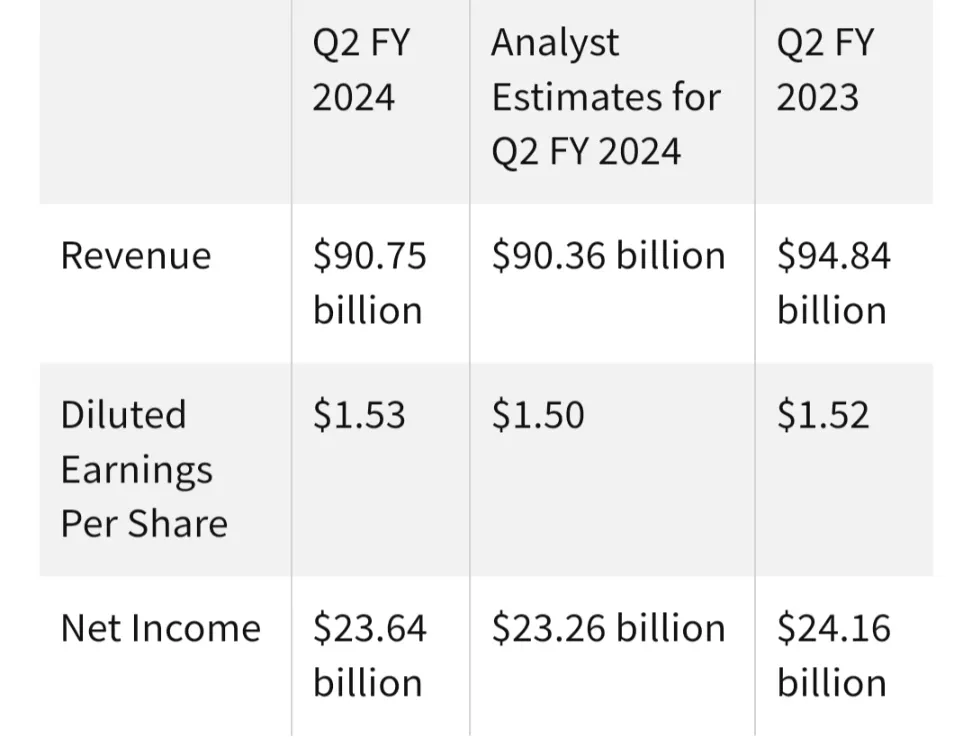

In the second quarter of fiscal 2024 (Apple), the company’s revenue was $90.75 billion. That’s a 4% drop in revenue from the year-ago period, but slightly more than analysts’ expectations.

The company’s net income of $23.64 billion was down from $24.16 billion in the year-ago quarter, while (Apple stock) earnings per share (EPS) rose slightly. Earnings numbers in these two areas topped analysts’ estimates.

Apple also reported current record-high services revenue of $23.87 billion, a 14% jump from revenue in the year-ago period.

“Thanks to the very high level of customer satisfaction and loyalty,” said Luca Maestri, the current Apple Company Chief Financial Officer (CFO). Luca also added “Our active installed device base reached a new all-time high across all products and all geographies and our business performance in March. The quarter was a new (EPS) record.” This message shows that he is very happy.

Sales of Apple’s much-anticipated iPhone dropped from $51.33 billion a year earlier to $45.96 billion in the most recent quarter. Investors were particularly interested in the company’s Greater China business, which reported revenue of $16.73 billion for the quarter ending in the previous year, up from $17.81 billion.

Apple’s share price increased 6% to $183.46 at approximately 7:30 p.m. ET. As of Thursday, the stock had lost 10% of its value this year due to affects about China’s economy and the situation of the iPhone industry.

Also read

India’s stock market in March saw foreign investment of 38 thousand crore rupees